Amazon has completed over 100 acquisitions since 1998, strategically expanding from an online bookstore into e-commerce, cloud computing, entertainment, groceries, healthcare, and smart home technology. Unlike competitors who often overpay for hype, Amazon is known for disciplined acquisitions that fill specific strategic gaps.

Under founder Jeff Bezos (1994-2021) and CEO Andy Jassy (2021-present), Amazon has spent over $50 billion on acquisitions. From the game-changing Whole Foods deal to the MGM entertainment acquisition, this guide documents Amazon's complete M&A history and what happened after each deal.

Amazon's M&A Philosophy: Fill the Gaps

Amazon's acquisition strategy differs from other tech giants. While Google and Meta often acquire for talent or to eliminate competitors, Amazon acquires to fill specific gaps in its strategy or accelerate entry into new markets.

Amazon's Acquisition Principles

- Build First: Amazon tries to build internally before acquiring. If internal efforts struggle, then consider M&A.

- Fill Gaps: Acquisitions should provide capabilities that would take too long to build.

- Cultural Fit: Target companies must align with Amazon's customer obsession and long-term thinking.

- Vertical Integration: Many acquisitions enable Amazon to control more of the value chain.

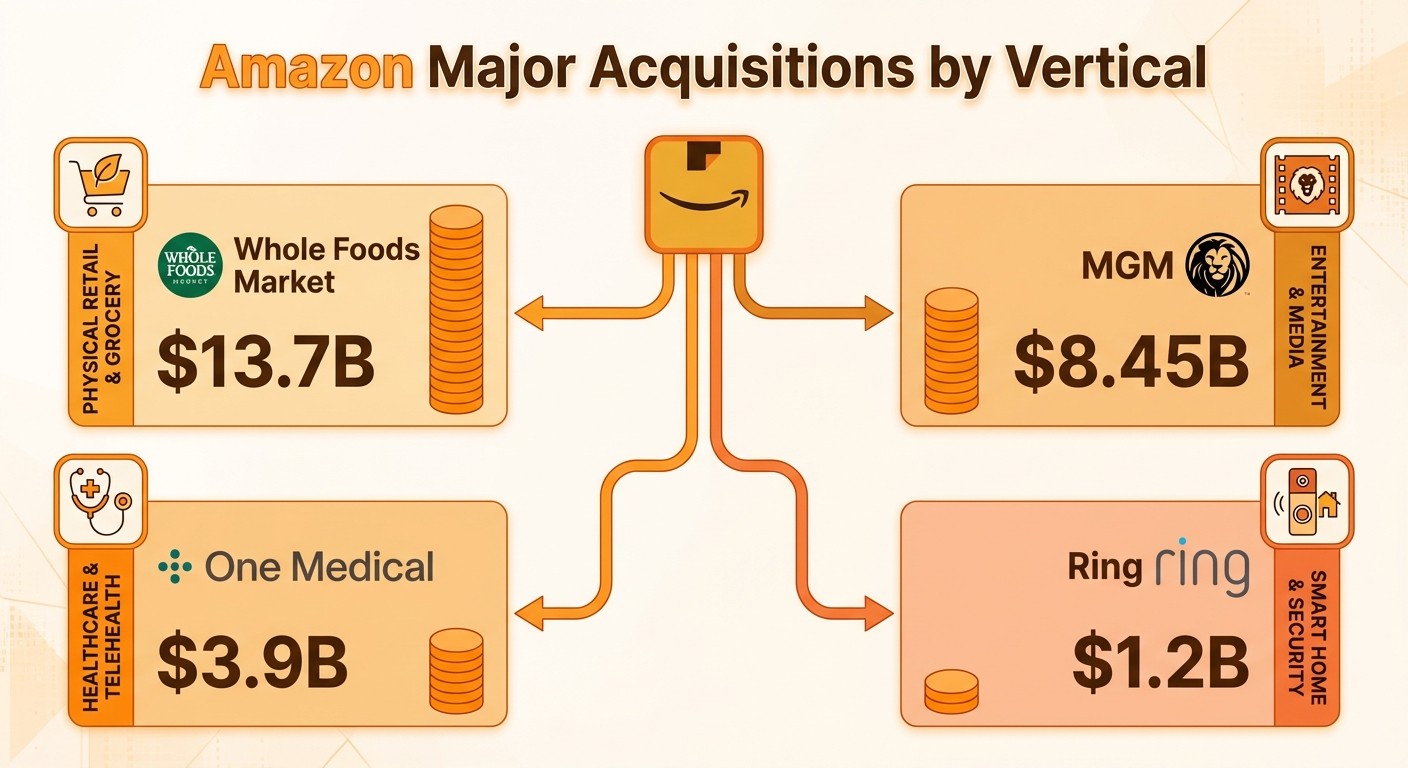

The 10 Largest Amazon Acquisitions

Amazon's biggest deals reveal its strategic priorities: content for Prime, physical retail presence, smart home dominance, and healthcare disruption.

| Rank | Company | Year | Price | Strategic Focus |

|---|---|---|---|---|

| 1 | Whole Foods Market | 2017 | $13.7B | Groceries/Retail |

| 2 | MGM | 2022 | $8.45B | Entertainment |

| 3 | One Medical | 2023 | $3.9B | Healthcare |

| 4 | iRobot | 2024* | $1.7B | Smart Home (Cancelled) |

| 5 | Ring | 2018 | $1.2B | Smart Home/Security |

| 6 | Twitch | 2014 | $970M | Gaming/Streaming |

| 7 | Zappos | 2009 | $1.2B | E-commerce |

| 8 | PillPack | 2018 | $753M | Healthcare/Pharmacy |

| 9 | Kiva Systems | 2012 | $775M | Logistics/Robotics |

| 10 | Audible | 2008 | $300M | Audio Content |

*iRobot acquisition was cancelled in January 2024 due to EU regulatory concerns.

Groceries & Physical Retail

Amazon's $13.7 billion Whole Foods acquisition in 2017 shocked the retail industry and signaled Amazon's serious intent to dominate physical retail and groceries.

Whole Foods Market (2017)

$13.7 BillionAmazon's largest acquisition ever gave it instant access to 500+ premium grocery stores nationwide. The deal immediately impacted grocery stocks and accelerated the digital transformation of traditional retailers.

Changes Since Acquisition:

- Prime member discounts at Whole Foods

- Amazon lockers in stores

- Grocery delivery integration with Prime

- Price reductions on staple items

- Amazon Fresh stores launched (separate concept)

Outcome: Mixed results. Whole Foods hasn't grown market share significantly, but provides crucial grocery infrastructure. The real value may be in the data and Prime integration.

Entertainment & Media

Amazon Prime Video competes with Netflix and Disney+ for streaming dominance. Key acquisitions support this strategy:

MGM (2022)

$8.45 BillionAmazon acquired the legendary movie studio with its 4,000+ film library (James Bond, Rocky, RoboCop) and 17,000+ TV episodes. The deal gives Prime Video a deep content library and IP for original productions.

Key Assets: James Bond franchise (partial rights), Rocky/Creed, The Handmaid's Tale, Fargo, Vikings, and classic films.

Outcome: Content integration ongoing. MGM+ streaming service merged into Prime Video. James Bond future projects remain complicated due to rights arrangements.

Twitch (2014)

$970 MillionAmazon beat Google to acquire the leading game streaming platform. Twitch has grown from 55 million monthly users (2014) to 140+ million (2024), becoming the dominant platform for gaming content.

Outcome: Highly successful. Twitch integrated with Prime Gaming (free games for Prime members). Platform now extends beyond gaming to music, talk shows, and live events.

Other Entertainment Acquisitions

- Audible (2008) - $300M - Audiobook marketplace, now dominant in audio content

- Goodreads (2013) - Undisclosed - Book social network with 150M+ members

- ComiXology (2014) - Undisclosed - Digital comics platform

- Double Helix Games (2014) - Undisclosed - Game studio (shut down 2023)

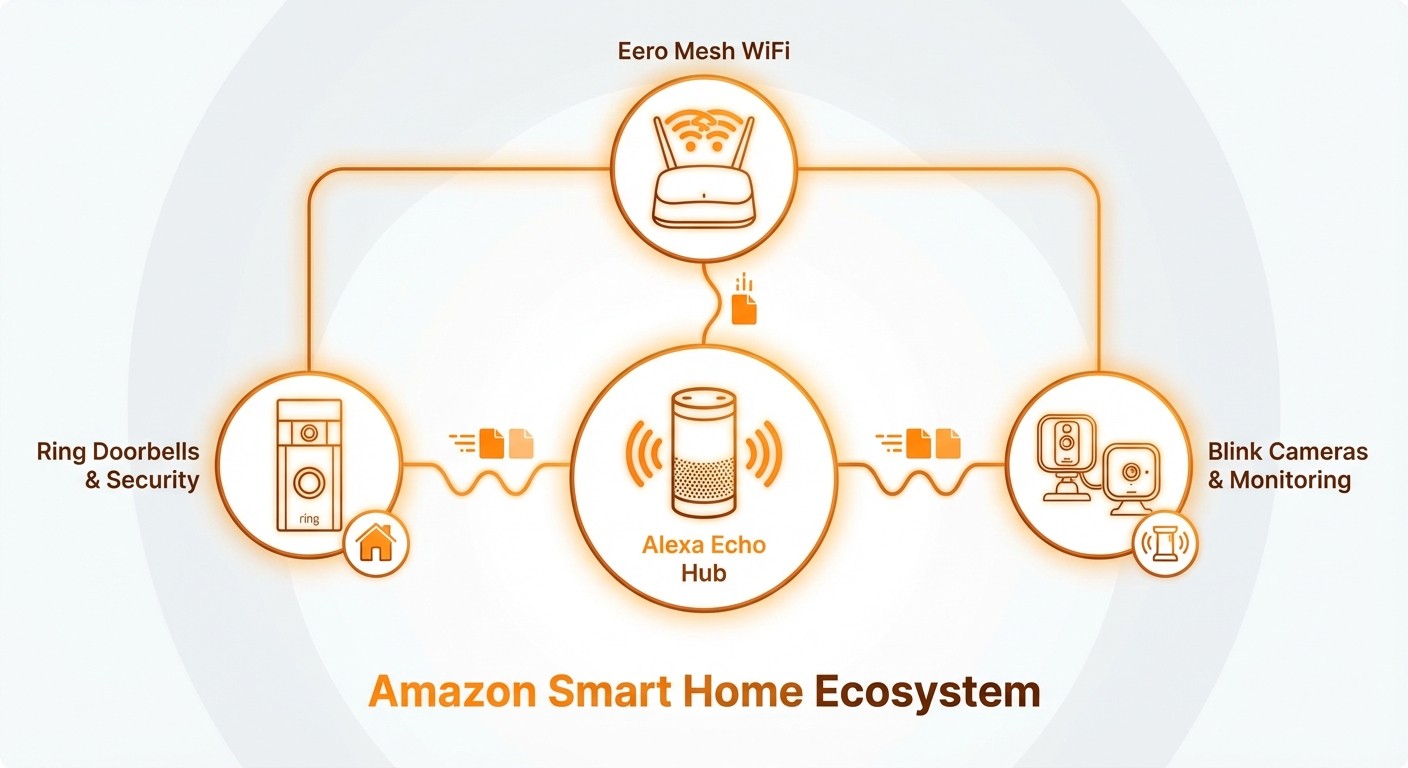

Smart Home & Devices

Amazon has acquired multiple companies to build its Alexa-powered smart home ecosystem:

Ring (2018)

$1.2 BillionThe video doorbell company was famously rejected on Shark Tank before becoming a category leader. Amazon acquired Ring to anchor its smart home security offering.

Outcome: Success with controversy. Ring dominates the video doorbell market but faced privacy concerns about police partnerships and data security. Amazon scaled back Neighbors police program in 2024.

Eero (2019)

$97 MillionMesh Wi-Fi pioneer Eero gives Amazon control over home network infrastructure—crucial for reliable smart home performance.

Outcome: Integrated into Alexa ecosystem. Eero devices work seamlessly with Ring, Echo, and other Amazon products.

Blink (2017)

$90 MillionHome security camera company acquired to complement Ring's doorbell focus with indoor/outdoor cameras.

Outcome: Operates as separate brand targeting price-conscious consumers. Blink offers cheaper alternatives to Ring cameras.

iRobot (Cancelled 2024)

$1.7B Deal CollapsedAmazon's planned acquisition of Roomba maker iRobot was blocked by EU regulators concerned about competitive effects. The deal was cancelled in January 2024 after 18 months of review.

Lesson: Regulatory scrutiny of big tech acquisitions is intensifying, especially in Europe.

Healthcare: Amazon's Next Frontier

Amazon has signaled major healthcare ambitions through strategic acquisitions:

One Medical (2023)

$3.9 BillionMembership-based primary care provider with 200+ locations. Gives Amazon physical healthcare presence and established patient relationships.

Strategy: Integrate with Amazon Pharmacy, offer Prime members discounted healthcare, and eventually disrupt traditional healthcare.

PillPack (2018)

$753 MillionOnline pharmacy that pre-sorts medications into daily packets. Became Amazon Pharmacy, entering the $500 billion pharmacy market.

Outcome: Launched Amazon Pharmacy in 2020. Offers Prime members discounts on medications. Competing with CVS, Walgreens for prescription delivery.

Amazon Healthcare Timeline

- 2018: Acquired PillPack, partnered with Berkshire/JP Morgan on Haven (later dissolved)

- 2019: Launched Amazon Care telemedicine (shut down 2022)

- 2020: Launched Amazon Pharmacy

- 2022: Announced One Medical acquisition

- 2023: Completed One Medical acquisition, launched RxPass ($5/month generics)

Logistics & Infrastructure

Amazon has quietly built the world's largest private logistics network, partly through acquisitions:

Kiva Systems (2012)

$775 MillionWarehouse robotics company whose orange robots revolutionized Amazon's fulfillment centers. Renamed to Amazon Robotics, these systems are now deployed across 500+ facilities.

Outcome: Transformational. Amazon stopped selling Kiva robots to competitors, forcing rivals to develop their own automation. Amazon now operates 750,000+ robots in its warehouses.

Other Logistics Acquisitions

- Canvas Technology (2019) - Autonomous cart technology for warehouses

- Dispatch (2017) - Last-mile delivery robots (small-scale)

- Zoox (2020) - $1.2B - Autonomous vehicle startup

E-Commerce Acquisitions

Amazon's core e-commerce business has been strengthened through key acquisitions:

Zappos (2009)

$1.2 BillionThe legendary shoe retailer known for exceptional customer service. Amazon acquired Zappos but allowed it to operate independently, preserving its unique culture.

Outcome: Zappos continues as a separate brand focused on customer experience. Tony Hsieh's holacracy experiment ended after his death in 2020. Some layoffs occurred but brand remains active.

Quidsi / Diapers.com (2010)

$545 MillionParent company of Diapers.com, Soap.com, and other sites. Amazon's aggressive pricing forced Quidsi to sell, then shut down the brands in 2017.

Outcome: Shut down. This is often cited as an example of Amazon acquiring to eliminate competition rather than grow the business.

Other E-Commerce Acquisitions

- Woot (2010) - $110M - Daily deals site (still operating)

- Fabric.com (2018) - Crafts e-commerce (shut down 2023)

- Souq.com (2017) - $580M - Middle East e-commerce (became Amazon.ae)

- Shopbop (2006) - Women's fashion (still operating)

AWS & Cloud Acquisitions

Amazon Web Services (AWS) is Amazon's most profitable business. Strategic acquisitions have strengthened its capabilities:

| Company | Year | Price | Technology |

|---|---|---|---|

| Elemental Technologies | 2015 | $500M | Video processing (AWS Elemental) |

| Harvest.ai | 2017 | $19M | Security analytics (AWS Macie) |

| CloudEndure | 2019 | $250M | Cloud migration tools |

| TSO Logic | 2019 | Undisclosed | Cloud optimization |

| E8 Security | 2019 | Undisclosed | Security AI |

Complete Amazon Acquisitions Timeline

2020s

| Year | Company | Price | Category |

|---|---|---|---|

| 2024 | iRobot (Cancelled) | $1.7B | Smart Home |

| 2023 | One Medical | $3.9B | Healthcare |

| 2022 | MGM | $8.45B | Entertainment |

| 2021 | Wickr | Undisclosed | Encrypted Messaging |

| 2020 | Zoox | $1.2B | Autonomous Vehicles |

2010s

| Year | Company | Price | Category |

|---|---|---|---|

| 2019 | Eero | $97M | Smart Home |

| 2018 | Ring | $1.2B | Smart Home |

| 2018 | PillPack | $753M | Healthcare |

| 2017 | Whole Foods | $13.7B | Groceries |

| 2017 | Souq.com | $580M | E-commerce |

| 2017 | Blink | $90M | Smart Home |

| 2015 | Elemental | $500M | Cloud/Video |

| 2014 | Twitch | $970M | Gaming/Streaming |

| 2013 | Goodreads | Undisclosed | Books/Social |

| 2012 | Kiva Systems | $775M | Robotics |

| 2010 | Quidsi | $545M | E-commerce |

| 2010 | Woot | $110M | E-commerce |

2000s

| Year | Company | Price | Category |

|---|---|---|---|

| 2009 | Zappos | $1.2B | E-commerce |

| 2008 | Audible | $300M | Audio Content |

| 2008 | Fabric.com | Undisclosed | E-commerce |

| 2006 | Shopbop | Undisclosed | E-commerce |

| 2005 | CreateSpace | Undisclosed | Publishing |

| 1999 | IMDB | $55M | Entertainment |

Frequently Asked Questions

What is Amazon's largest acquisition ever?

Amazon's largest acquisition is Whole Foods Market for $13.7 billion in 2017. The MGM acquisition ($8.45 billion, 2022) is the second largest. Both deals represented Amazon's expansion into physical retail and entertainment content.

How many companies has Amazon acquired?

Amazon has acquired over 100 companies since 1998. The company is more selective than Google or Microsoft, preferring to build internally when possible and only acquiring to fill specific strategic gaps or accelerate market entry.

Does Amazon own Whole Foods?

Yes, Amazon acquired Whole Foods Market for $13.7 billion in 2017. The acquisition gave Amazon 500+ physical grocery stores and established its presence in the grocery industry. Prime members receive special discounts at Whole Foods.

Does Amazon own Twitch?

Yes, Amazon acquired Twitch for $970 million in 2014, beating Google's competing offer. Twitch has grown from 55 million to 140+ million monthly users under Amazon ownership. Twitch is integrated with Prime Gaming, which offers free games to Prime members.

Why did Amazon buy MGM?

Amazon acquired MGM for $8.45 billion in 2022 to strengthen Prime Video's content library. MGM brings 4,000+ films (including James Bond) and 17,000+ TV episodes. The acquisition helps Amazon compete with Netflix, Disney+, and other streaming services.

What happened to the Amazon iRobot deal?

Amazon's $1.7 billion acquisition of iRobot (Roomba maker) was cancelled in January 2024 after EU regulators raised competition concerns. The deal faced 18 months of regulatory scrutiny before Amazon abandoned it to avoid an EU lawsuit.

Does Amazon own Ring?

Yes, Amazon acquired Ring for approximately $1.2 billion in 2018. Ring was founded by Jamie Siminoff after his video doorbell was rejected on Shark Tank. Under Amazon ownership, Ring has become the leading video doorbell brand despite some privacy controversies.

Is Amazon in healthcare?

Yes, Amazon has made major healthcare investments including PillPack ($753M, 2018) which became Amazon Pharmacy, and One Medical ($3.9B, 2023) for primary care. Amazon also offers RxPass, a $5/month subscription for generic medications for Prime members.

What happened to Zappos after Amazon bought it?

Zappos continues to operate as a separate brand under Amazon ownership since the 2009 acquisition ($1.2B). Amazon allowed Zappos to maintain its unique culture. After founder Tony Hsieh's death in 2020, Zappos ended its holacracy experiment but remains operational.

Does Amazon own Audible?

Yes, Amazon acquired Audible for $300 million in 2008. Audible is now the dominant audiobook platform with 500,000+ titles. Audible memberships are popular with Amazon Prime members, and the service is integrated into the Kindle and Echo ecosystems.

How much has Amazon spent on acquisitions?

Amazon has spent over $50 billion on acquisitions since 1998. Major deals include Whole Foods ($13.7B), MGM ($8.45B), One Medical ($3.9B), Ring ($1.2B), Zappos ($1.2B), Twitch ($970M), and Kiva Systems ($775M).

What companies has Amazon shut down after acquiring?

Amazon has shut down several acquired companies including Quidsi/Diapers.com (2017), Fabric.com (2023), Double Helix Games (2023), and Amazon Care (internal project, 2022). These shutdowns often occur when the business doesn't scale or becomes redundant with other Amazon offerings.