Microsoft has executed over 250 acquisitions since 1987, spending more than $100 billion to transform from a PC software vendor into a diversified technology powerhouse. From gaming to cloud computing to professional networking, Microsoft's M&A strategy has reshaped entire industries.

Under CEO Satya Nadella (2014-present), Microsoft has pursued its most aggressive acquisition strategy ever, including the largest gaming acquisition in history—the $68.7 billion purchase of Activision Blizzard. This comprehensive guide documents every significant Microsoft acquisition, the strategic logic behind each deal, and the outcomes that followed.

Microsoft's M&A Philosophy: Build, Buy, or Partner

Microsoft's acquisition strategy has evolved dramatically over its 50-year history. Under Bill Gates, the company preferred to build internally or license technology. Steve Ballmer expanded acquisitions but missed key opportunities (notably, the mobile revolution). Satya Nadella has transformed Microsoft into one of tech's most aggressive acquirers.

The Three Eras of Microsoft M&A

- Gates Era (1975-2000): Focus on organic growth, few acquisitions, preference for licensing

- Ballmer Era (2000-2014): Defensive acquisitions, mixed results (aQuantive write-off, Nokia struggles)

- Nadella Era (2014-Present): Strategic acquisitions in cloud, gaming, AI, and developer tools

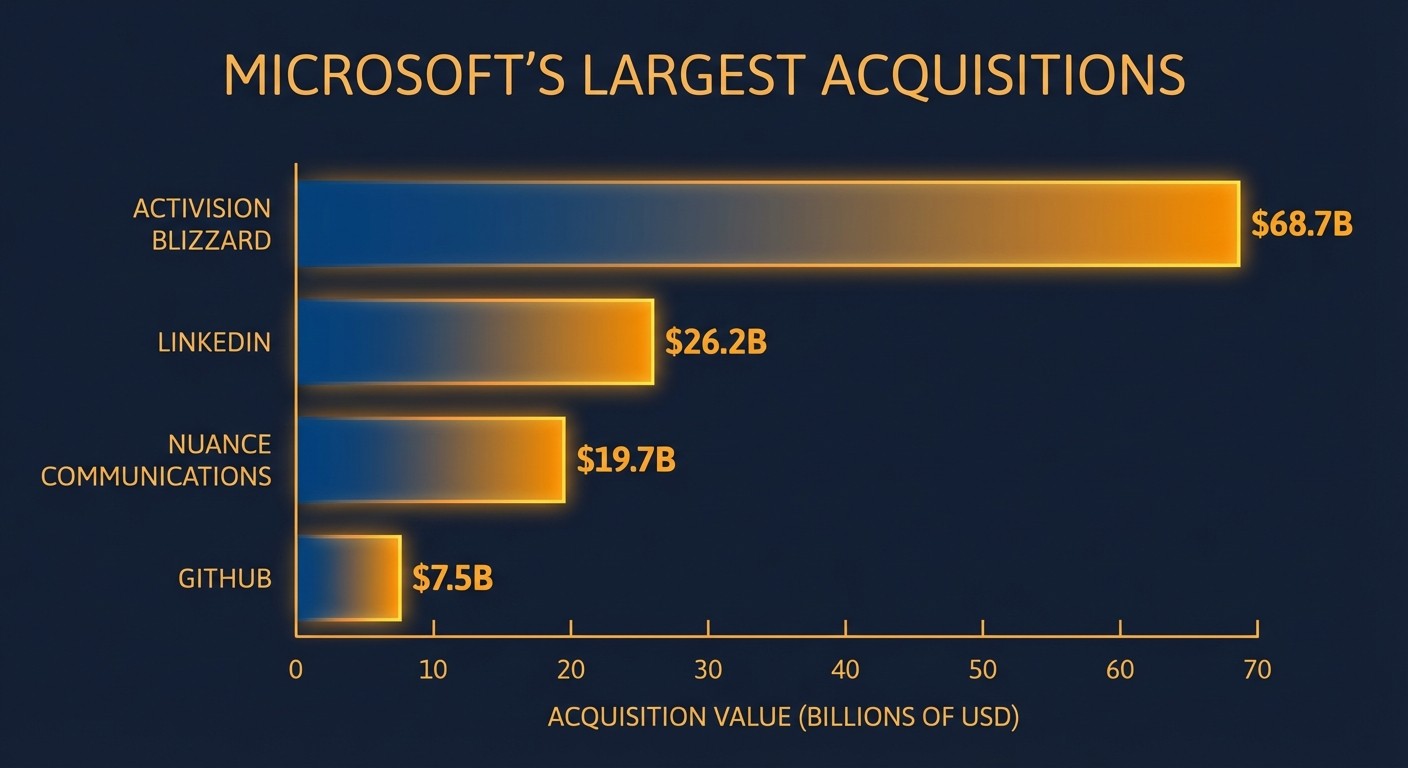

The 10 Largest Microsoft Acquisitions

Microsoft's biggest deals reveal its strategic priorities: gaming dominance, enterprise software, professional networking, and developer tools.

| Rank | Company | Year | Price | Strategic Focus |

|---|---|---|---|---|

| 1 | Activision Blizzard | 2023 | $68.7B | Gaming |

| 2 | 2016 | $26.2B | Professional Network | |

| 3 | Nuance Communications | 2021 | $19.7B | AI/Healthcare |

| 4 | ZeniMax Media | 2021 | $7.5B | Gaming |

| 5 | GitHub | 2018 | $7.5B | Developer Tools |

| 6 | Nokia (Devices) | 2014 | $7.2B | Mobile (Failed) |

| 7 | aQuantive | 2007 | $6.3B | Advertising (Failed) |

| 8 | Skype | 2011 | $8.5B | Communications |

| 9 | Mojang | 2014 | $2.5B | Gaming |

| 10 | Yammer | 2012 | $1.2B | Enterprise Social |

Gaming: Microsoft's Biggest Bet

Gaming has become Microsoft's most active acquisition category, with over $80 billion spent on gaming companies since 2020 alone. The strategy: build the Netflix of gaming through Xbox Game Pass.

Key Gaming Acquisitions

Activision Blizzard (2023)

$68.7 BillionThe largest gaming acquisition in history. After 18 months of regulatory scrutiny from the FTC, UK CMA, and EU Commission, Microsoft completed the deal in October 2023. Activision brings Call of Duty, World of Warcraft, Candy Crush, and Overwatch to Microsoft's portfolio.

Outcome: Still integrating. Call of Duty Modern Warfare III launched on Game Pass day one. Activision games now available on Xbox Game Pass.

ZeniMax Media / Bethesda (2021)

$7.5 BillionAcquired the parent company of Bethesda Softworks, bringing The Elder Scrolls, Fallout, DOOM, and other franchises to Microsoft. This was the deal that signaled Microsoft's aggressive gaming strategy.

Outcome: Success. Starfield launched as Xbox/PC exclusive. All Bethesda titles on Game Pass. Studios integrated into Xbox Game Studios.

Mojang / Minecraft (2014)

$2.5 BillionMany criticized the $2.5 billion price for a single game. A decade later, Minecraft has 170+ million monthly active users and has generated billions in revenue across games, merchandise, and media.

Outcome: Massive success. One of Microsoft's best acquisitions ever. Minecraft is now the best-selling video game of all time (300+ million copies).

Other Gaming Studios Acquired

- Rare (2002) - $375M - Banjo-Kazooie, Sea of Thieves

- Lionhead Studios (2006) - Undisclosed - Fable series (closed 2016)

- Ninja Theory (2018) - Undisclosed - Hellblade

- Playground Games (2018) - Undisclosed - Forza Horizon

- Obsidian Entertainment (2018) - Undisclosed - Fallout: New Vegas, Outer Worlds

- inXile Entertainment (2018) - Undisclosed - Wasteland series

- Double Fine (2019) - Undisclosed - Psychonauts

- Compulsion Games (2018) - Undisclosed - We Happy Few

Enterprise & Cloud Acquisitions

Beyond gaming, Microsoft has strategically acquired companies that strengthen Azure and its enterprise offerings.

LinkedIn: The $26 Billion Professional Network

Microsoft's 2016 acquisition of LinkedIn remains controversial. At $26.2 billion, it was the largest tech acquisition at the time. Critics questioned the price, but LinkedIn has become deeply integrated into Microsoft 365, and the professional network now has 1 billion members.

LinkedIn Integration Results

- LinkedIn data powers Microsoft 365 contact cards and organizational insights

- LinkedIn Learning integrated with Microsoft Viva

- Sales Navigator connects with Dynamics 365

- Revenue growth from $3B (2016) to $15B+ (2024)

GitHub: The Developer Platform

When Microsoft announced the $7.5 billion GitHub acquisition in 2018, developers panicked. Microsoft had a reputation for hostility toward open source. Under Satya Nadella, the company had changed, and GitHub has thrived.

Results: GitHub grew from 28 million developers (2018) to 100+ million (2024). GitHub Copilot, powered by OpenAI, generates $100M+ ARR. GitHub Actions and Codespaces expanded the platform beyond code hosting.

Other Key Enterprise Acquisitions

| Company | Year | Price | Purpose |

|---|---|---|---|

| Nuance Communications | 2021 | $19.7B | Healthcare AI, voice recognition |

| Yammer | 2012 | $1.2B | Enterprise social networking |

| Xamarin | 2016 | $500M | Cross-platform mobile development |

| Revolution Analytics | 2015 | Undisclosed | R programming, data science |

| Semantic Machines | 2018 | Undisclosed | Conversational AI |

| Affirmed Networks | 2020 | $1.35B | 5G network software |

Failed Acquisitions: Lessons Learned

Not every Microsoft acquisition has succeeded. Two deals stand out as cautionary tales:

aQuantive (2007)

$6.3B Write-OffMicrosoft acquired ad tech company aQuantive for $6.3 billion to compete with Google's DoubleClick acquisition. The deal was a disaster. Microsoft wrote off the entire purchase price in 2012—one of the largest write-offs in tech history.

Lesson: Acquiring technology doesn't guarantee you can compete in an established market where you lack distribution.

Nokia Devices & Services (2014)

$7.6B Write-DownSteve Ballmer's final major acquisition was Nokia's phone division. The goal: compete with Apple and Android. Within two years, Microsoft wrote off $7.6 billion and laid off 18,000 employees. Windows Phone was discontinued.

Lesson: Hardware acquisitions are risky. Platform ecosystems (iOS, Android) have winner-take-all dynamics.

AI & Future-Focused Acquisitions

While Microsoft's $13 billion investment in OpenAI is technically a partnership (not acquisition), Microsoft has made several AI-focused acquisitions:

- Nuance Communications (2021) - $19.7B - Healthcare AI and speech recognition

- Semantic Machines (2018) - Conversational AI for Cortana

- Lobe (2018) - No-code machine learning tools

- XOXCO (2018) - Chatbot development

- Bonsai (2018) - Industrial AI platform

- Maluuba (2017) - Deep learning research (Montreal)

- SwiftKey (2016) - $250M - Predictive keyboard AI

Complete Microsoft Acquisitions Timeline

Below is a comprehensive list of significant Microsoft acquisitions organized by decade:

2020s (Selected Major Deals)

| Year | Company | Price | Category |

|---|---|---|---|

| 2023 | Activision Blizzard | $68.7B | Gaming |

| 2022 | Xandr (from AT&T) | $1B | Advertising |

| 2021 | Nuance Communications | $19.7B | AI/Healthcare |

| 2021 | ZeniMax Media | $7.5B | Gaming |

| 2021 | RiskIQ | $500M | Cybersecurity |

| 2020 | ZeniMax Media | $7.5B | Gaming |

| 2020 | Affirmed Networks | $1.35B | 5G/Telecom |

2010s (Selected Major Deals)

| Year | Company | Price | Category |

|---|---|---|---|

| 2018 | GitHub | $7.5B | Developer Tools |

| 2016 | $26.2B | Professional Network | |

| 2016 | Xamarin | ~$500M | Developer Tools |

| 2014 | Mojang (Minecraft) | $2.5B | Gaming |

| 2014 | Nokia Devices | $7.2B | Mobile |

| 2012 | Yammer | $1.2B | Enterprise |

| 2011 | Skype | $8.5B | Communications |

2000s (Selected Major Deals)

| Year | Company | Price | Category |

|---|---|---|---|

| 2008 | Danger | $500M | Mobile |

| 2008 | FAST Search | $1.2B | Search |

| 2007 | aQuantive | $6.3B | Advertising |

| 2006 | Lionhead Studios | Undisclosed | Gaming |

| 2002 | Rare | $375M | Gaming |

| 2002 | Navision | $1.3B | ERP |

| 2001 | Great Plains | $1.1B | Business Software |

Frequently Asked Questions

What is Microsoft's largest acquisition ever?

Microsoft's largest acquisition is Activision Blizzard for $68.7 billion, completed in October 2023. This is also the largest gaming acquisition in history. The deal faced 18 months of regulatory scrutiny before final approval.

How many companies has Microsoft acquired?

Microsoft has acquired over 250 companies since 1987. The pace of acquisitions accelerated significantly under CEO Satya Nadella (2014-present), with major deals in gaming, enterprise software, and AI.

Why did Microsoft acquire Activision Blizzard?

Microsoft acquired Activision Blizzard to strengthen Xbox Game Pass, gain popular franchises (Call of Duty, World of Warcraft, Candy Crush), and compete with Sony PlayStation. The goal is to build the "Netflix of gaming."

Was the LinkedIn acquisition successful?

The LinkedIn acquisition is considered successful. Despite initial skepticism about the $26.2B price, LinkedIn has grown from 433 million members (2016) to over 1 billion (2024), with revenue increasing from $3B to $15B+. LinkedIn is now deeply integrated into Microsoft 365.

What happened to Microsoft's Nokia acquisition?

The Nokia devices acquisition (2014, $7.2B) failed. Microsoft wrote off $7.6 billion and laid off 18,000 employees. Windows Phone was discontinued in 2017. The deal is considered one of the worst tech acquisitions in history.

Does Microsoft own GitHub?

Yes, Microsoft acquired GitHub for $7.5 billion in 2018. Despite initial developer concerns, GitHub has thrived under Microsoft ownership, growing from 28 million to 100+ million developers. GitHub Copilot, powered by OpenAI, is now a major revenue driver.

How much has Microsoft spent on gaming acquisitions?

Microsoft has spent over $80 billion on gaming acquisitions since 2020, including Activision Blizzard ($68.7B), ZeniMax Media ($7.5B), and Mojang ($2.5B). This makes Microsoft the most aggressive acquirer in gaming history.

Did Microsoft buy Minecraft?

Yes, Microsoft acquired Mojang (the studio behind Minecraft) for $2.5 billion in 2014. Critics called the price excessive, but Minecraft has become one of Microsoft's best acquisitions ever—it's now the best-selling video game of all time with 300+ million copies sold.

What AI companies has Microsoft acquired?

Microsoft's AI acquisitions include Nuance Communications ($19.7B, healthcare AI), SwiftKey ($250M, predictive text), Semantic Machines (conversational AI), Lobe (no-code ML), and Maluuba (deep learning). Note: OpenAI is a partnership/investment, not an acquisition.

Who approves Microsoft acquisitions?

Large Microsoft acquisitions require approval from multiple regulators: the FTC (US), European Commission (EU), CMA (UK), and others depending on geography. The Activision deal faced 18 months of regulatory review before approval. The Microsoft board and shareholders must also approve major deals.

What does Microsoft do with acquired companies?

Microsoft typically integrates acquisitions into its ecosystem while maintaining brand identity. LinkedIn operates independently, GitHub kept its platform, and Xbox Game Studios retain studio brands. However, some acquisitions are fully absorbed (Skype into Teams) or shut down (Nokia mobile).

Is Microsoft still acquiring companies in 2025?

Yes, Microsoft continues to acquire companies, though the pace may slow after the massive Activision deal. Focus areas include AI, cybersecurity, and cloud infrastructure. Regulatory scrutiny of large tech acquisitions has increased, which may affect future mega-deals.